What should you know before investing in a condo?

A condo is a short form of a Condominium residence. Buying a Condo is different from buying a house. There are some restrictions and regulations when it comes to condominiums. You may have heard that some people have mortgage issues when they apply for Condo...

If you are a homeowner age 55+, you can access up to 55% of your home equity with the CHIP Reverse Mortgage. Discover how you can live the retirement of your dreams by clicking on the link below. Contact us to learn more. https://youtu.be/xHpyTtRbuUg

Products of note for Ontario Home-buyers

In Ontario and across Canada, home-buyers that meet the lending guidelines can purchase a home with only 5% down. This is not limited to first time home buyers. There are restrictions. If the purchase price is over $500,000.00 they will need 5% of the first...

New Real Estate Regulations that will change the Bidding Process

The Ontario government has announced new real estate regulations that could change the way bidding processes play out. In mid-April, it was announced that new regulation would allow home sellers to share bids on their property and disclose the details of competing...

Spring Cleaning To Do List

Spring has officially sprung, so it’s time to start thinking about spring cleaning! But what areas of our home should we target? What chores should make the cut? Let’s narrow down a few of the important ones to tackle this spring! Clean under the fridge and stove: ...

Canadian Housing Market Showing Signs of “Cooling”?

Real Estate professionals have stated they are already seeing a “cool off” in recent weeks in the Canadian housing market. What’s the reason for this sudden change?In an effort to tame inflation, central banks across the world have indicated that they intend to hike...

Mortgage Tips that will save you time and money!

We all want the best mortgage rate we can get, but we should also make sure that the mortgage we end up in works in our best interests. Here are some tips to keep in mind when choosing your mortgage!Pre-payment options - As interest rates rise, so does...

How to help cope with rising inflation

As rates start to climb you may be wondering how to cope? You’re not alone! According to Statistics Canada, the Consumer Price Index rose at an annual rate of 5.1% in January. A record-breaking peak in the cost of food contributed to the cost of living going up at its...

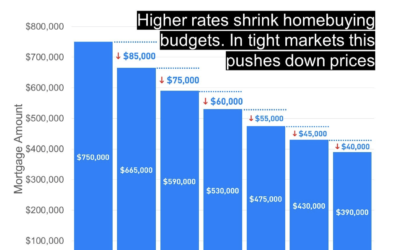

Interest Rate forecasts for 2022

Here are what the big banks are predicting for interest rates in 2022 and a graph on how those changes affect purchase prices. Interest Rate forecasts for 2022"This might be why it is time to get a new mortgage or to review your current mortgage"Canada’s biggest banks...

100% Online Mortgage Financing

You can do it all online, and upon your request, a specialist will help you to find the best mortgage solution, all with no phone calls, and no bank meetings.