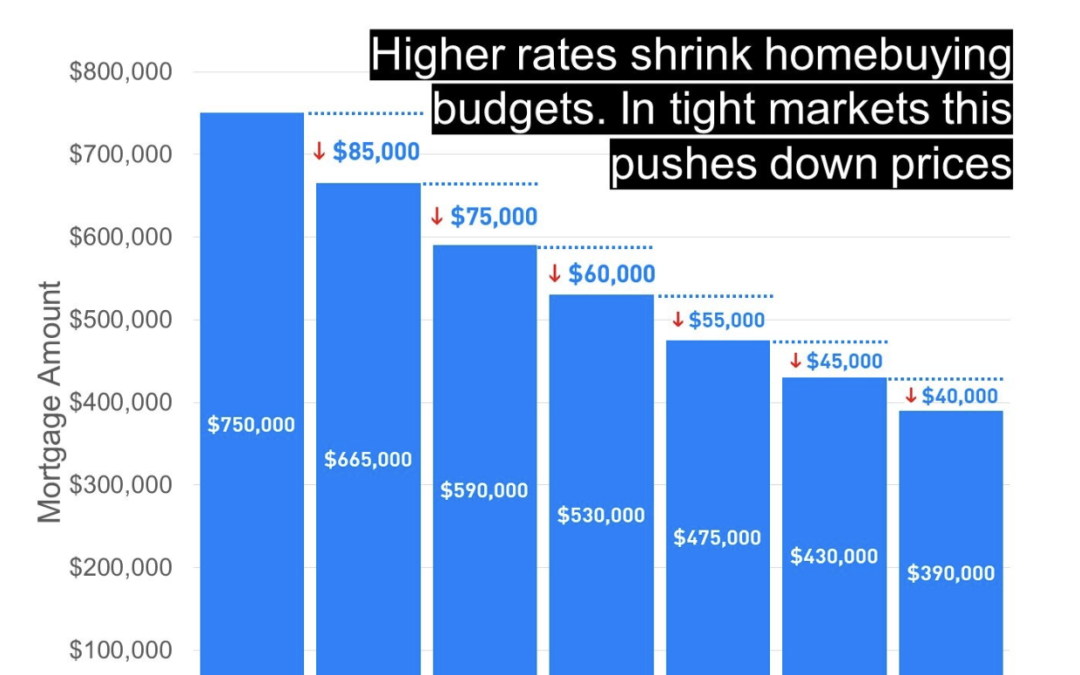

Here are what the big banks are predicting for interest rates in 2022 and a graph on how those changes affect purchase prices.

Interest Rate forecasts for 2022

“This might be why it is time to get a new mortgage or to review your current mortgage”

Canada’s biggest banks interest rates predictions for 2022

Scotiabank

1% increase – As a result, we now expect the Fed to raise interest rates by 25 bps in June followed by another 75 bps of tightening by year-end, with a risk of an earlier launch to the hiking cycle.(1)

TD

1.25% increase – Economists at TD Bank have updated their call on interest rates in Canada, and now believe the Bank of Canada will need to raise its benchmark rate four times in 2022 to hit 1.25% (2)

BMO

1% increase – BMO sees the central bank moving sooner, but they don’t see subsequent hikes occurring very quickly. The forecast shows the overnight rate hitting 1.25 percent by the end of next year. (3)

CIBC

.75% Increase (4)

National Bank

1.5% increase

National Bank Of Canada Calls 2022 “The Year Of The Hike,” Sees Rates 6x Higher (5)

RBC

.75% increase (6)

This is what the market is predicting for interest rates in 2022

Markets

1.25% increase – Traders are currently pricing in five 25-basis-point rate hikes in 2022. (7)

Text or call me anytime to discuss this or any mortgage-related topic

1. https://www.scotiabank.com/…/eco…/forecast-snapshot.html

2. https://economics.td.com/ca-long-term-forecast

3. https://betterdwelling.com/the-bank-of-canada-will-raise…/

4. https://economics.cibccm.com/cds…

5. https://betterdwelling.com/national-bank-of-canada-calls…/

6. http://www.rbc.com/…/pdf/financial-markets/rates.pdf

7. https://tradingeconomics.com/canada/forecast